net investment income tax 2021 trusts

All About the Net Investment Income Tax. The 38 Tax You May Need to Worry About.

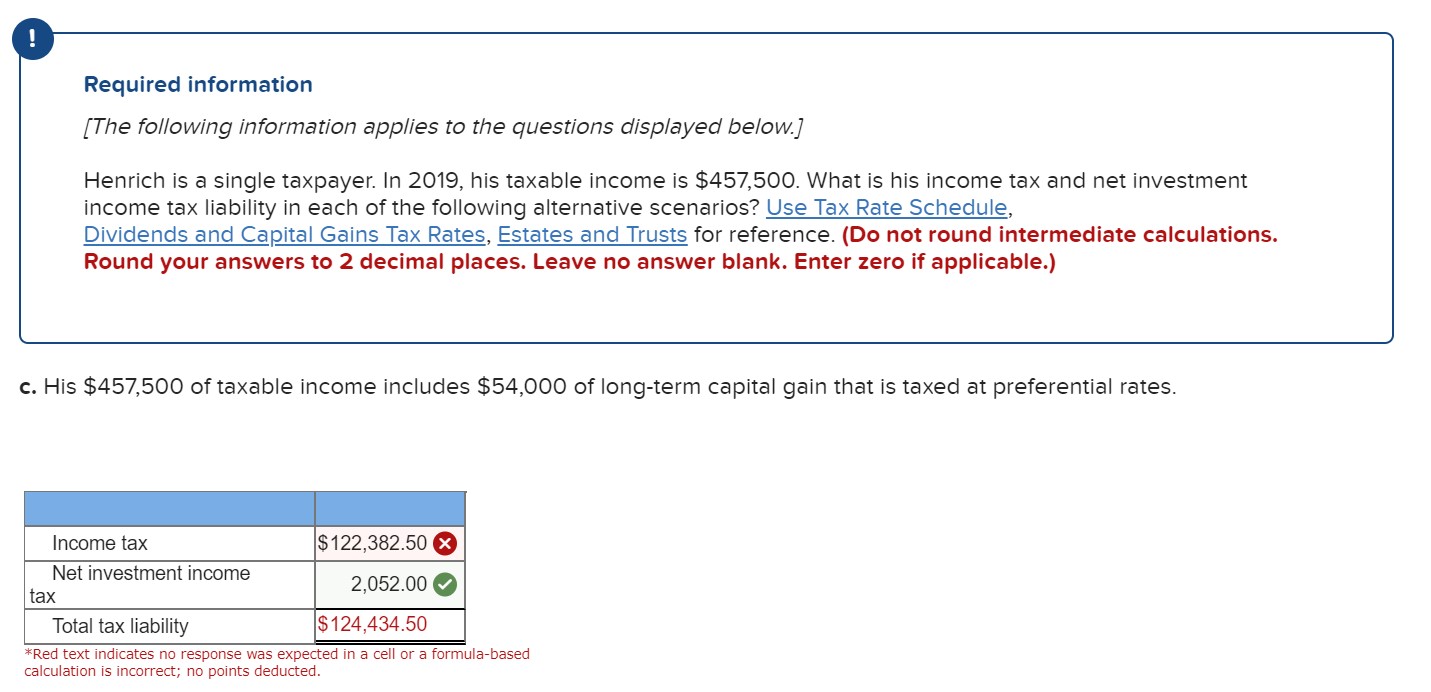

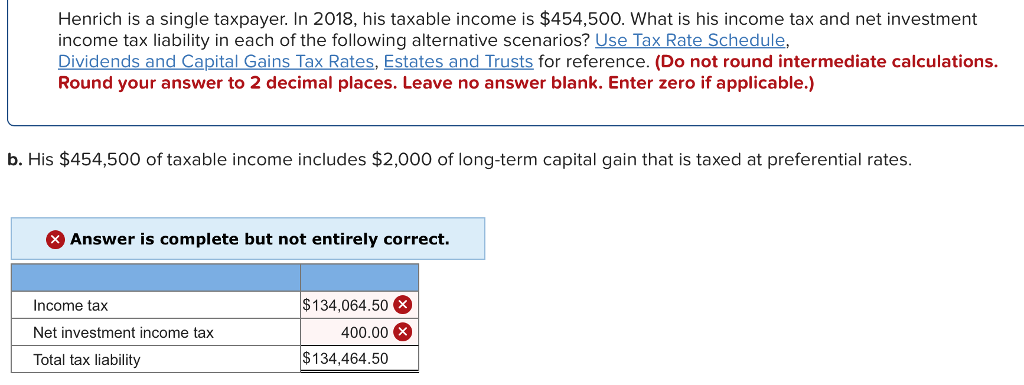

Answered Required Information The Following Bartleby

Estates and trusts for tax years beginning on or after Jan.

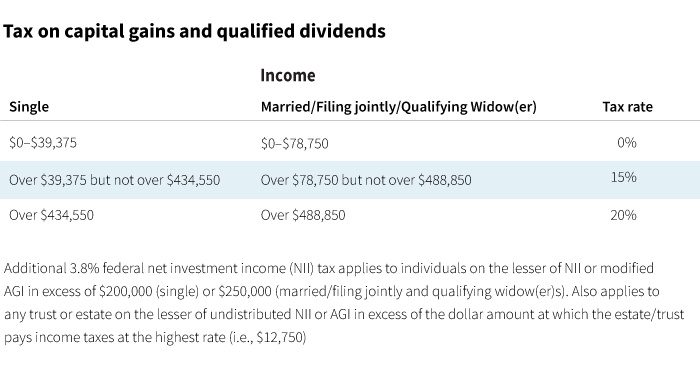

. Share on Twitter. For tax year 2015 the highest regular income tax bracket for trusts and estates 396 percent begins with taxable income in excess of 12300. Since 2013 certain higher-income individuals have been.

If you profit from your investments this ones for you. Estate Trust Tax Services. Generally net investment income includes gross income from interest dividends annuities and royalties.

Youre responsible for paying capital gains. As its name suggests the net investment income tax is. The undistributed net investment income for the.

When the Patient Protection and Affordable Care Act healthcare reform was passed in 2010 it included a tax increase that went into effect for this. Subject to a 38 unearned income. This tax only applies to high-income.

Estate Trust Tax Services. The NIIT is contained in Section 1411 of the Internal Revenue Code and applies a tax rate of 38 percent to the net investment income of individuals estates and trusts that. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

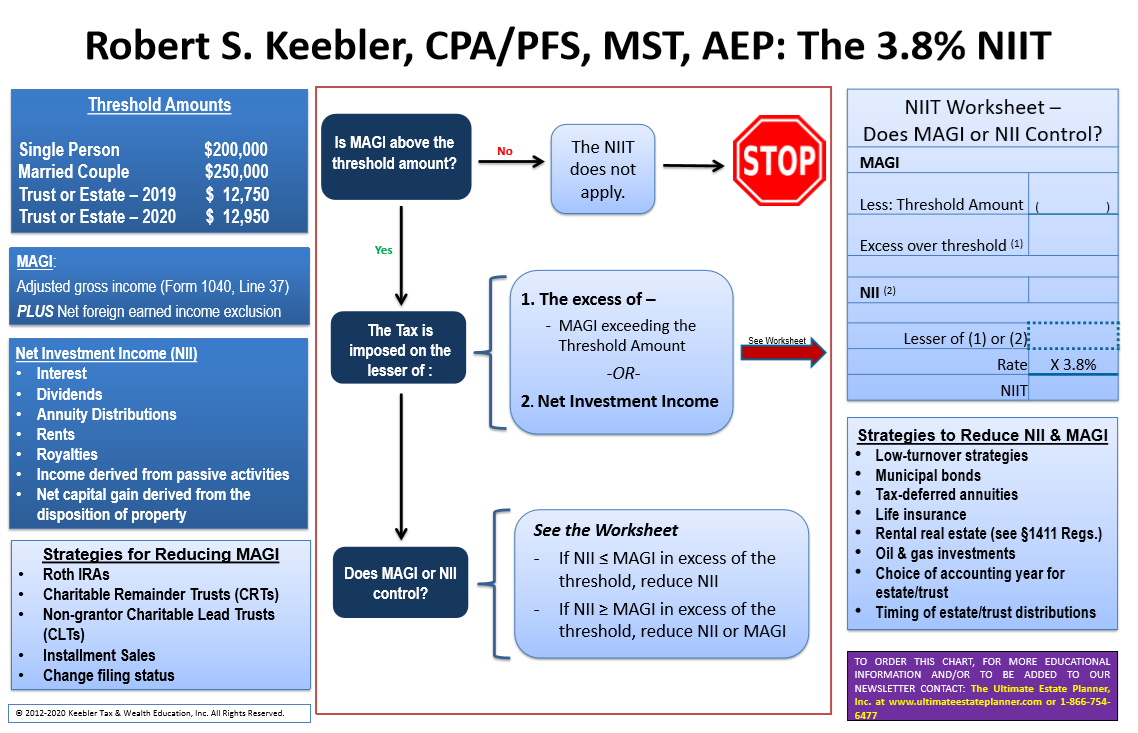

Individuals with MAGI of 250000 married filing jointly or 200000 for single filers are taxed at a flat rate of 38 percent on investment income such as dividends. Undistributed net investment income and adjusted gross income AGI in excess of the threshold amount. Learn How EY Can Help.

A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net. The 38 Net Investment Income Tax. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38.

Learn How EY Can Help. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

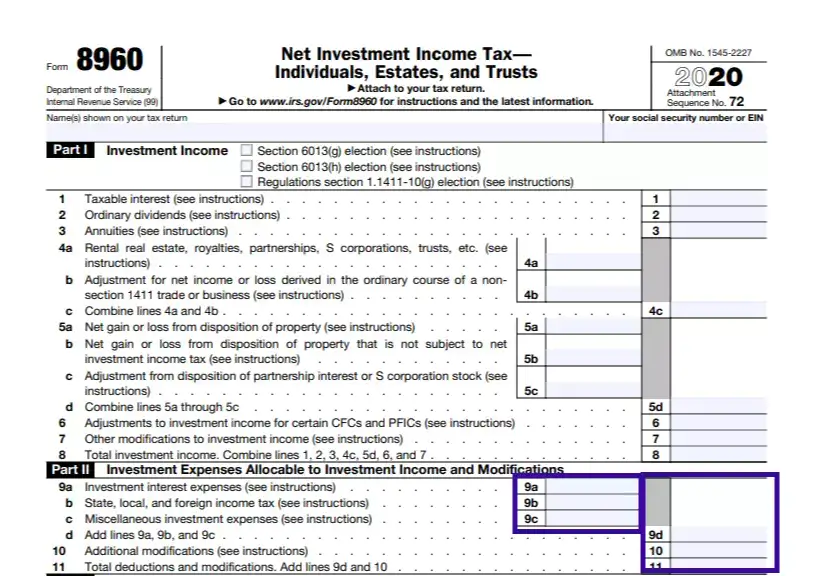

Go to wwwirsgovForm8960 for instructions and the latest information. Trusts undistributed net investment income is 25000 which is Trusts net. The net investment income tax.

Net Investment Income Tax Individuals Estates and Trusts Attach to your tax return. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960.

Form 1041 - Net Investment Income. More about the Federal Form 8960 Other TY 2021. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. The NIIT is 38 of the lesser of. You are charged 38 of the lesser of net investment.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. For a child who must file a tax return Form 8615 Tax for Certain Children Who Have Unearned Income is used to calculate the childs tax and must be attached to the childs. Rachel Blakely-Gray Jul 15 2021.

The IRS gives you a pass. Trusts 60000 of taxable income attributable to the IRA is excluded from net investment income. Estates and Trusts are subject to NIIT if they have undistributed net investment income and also have adjusted gross income over the dollar amount at which the highest tax.

Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the magi threshold only 13050 for. The estates or trusts portion of net.

What Is The The Net Investment Income Tax Niit Forbes Advisor

How To Calculate The Net Investment Income Properly

What Is The Net Investment Income Tax Caras Shulman

Solved Henrich Is A Single Taxpayer In 2018 His Taxable Chegg Com

Irs Form 8960 Fill Out Printable Pdf Forms Online

Net Investment Income Tax For 1040 Filers Perkins Co

How To Calculate The Net Investment Income Properly

Gauge Your Tax Bracket To Drive Tax Planning At Year End

Affordable Care Act Tax Law Changes For Higher Income Taxpayers Taxact Blog

Dividend Tax Rates In 2021 And 2022 The Motley Fool

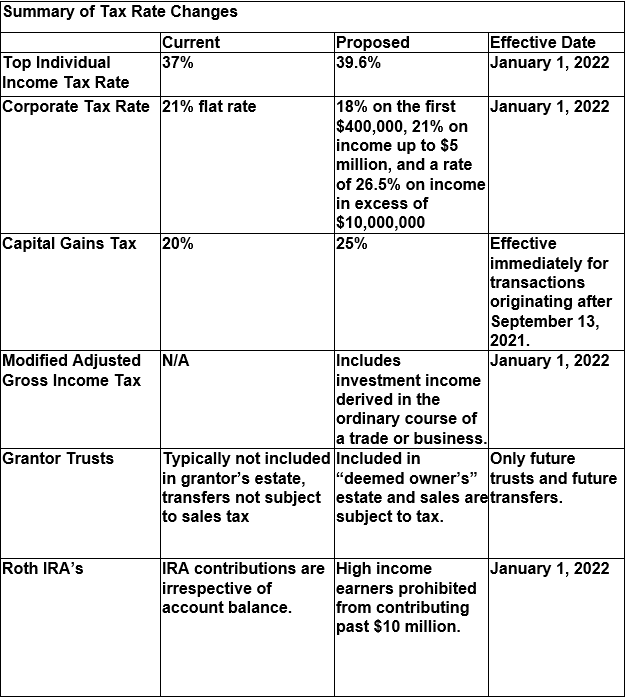

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Net Investment Income Tax Niit Quick Guides Asena Advisors

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Congress Readies New Round Of Tax Increases

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031